Useful Things to Know When Filing an Insurance Claim

Be honest. How well do you know your own insurance policy? Almost everyone in the USA holds, or is listed on, at least one or more insurance policies ranging from health, auto, life, and property. That insurance policy could mean the difference between financial ruin or not in the event of an unfortunate incident. And there are plenty of consumers out there who don’t even know the details of their policies!

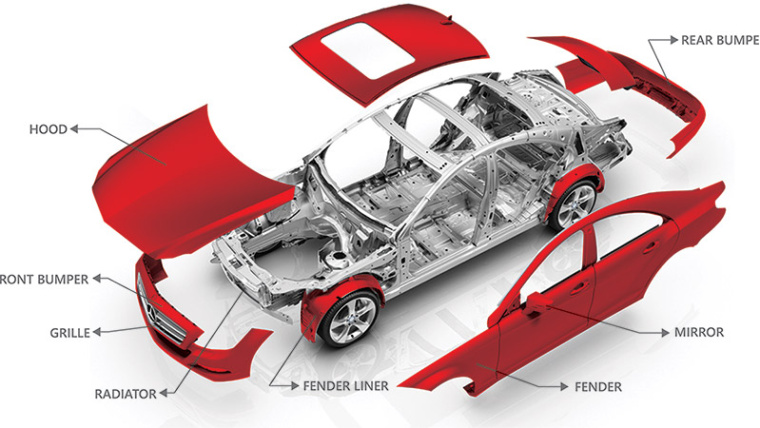

This unfortunately leaves room for deceptive or fraudulent practices by insurance companies. Dollars and cents are their top priority. So it’s in your best interest to educate yourself on your rights just in case you ever find yourself in the position where you need to file an insurance claim. Too often insurance companies would prefer to use inferior parts because they’re less expensive. Too often insurance companies steer customers to using shops in their network that focus on quantity over quality. Keep the following in mind when dealing with your insurance company:

- You have the right to have your automobile repaired in the registered shop of your choice. Your insurance company cannot steer you otherwise. You are not required to have your automobile repaired or appraised in a shop recommended by the insurance company. Whether you drive an average or a luxury vehicle, foreign or domestic, you have the right to equal treatment under the law to have your car repaired at a qualified repair facility.

- You are not required to get multiple estimates.

- You are not required to take your car to an insurance company’s drive-in claim service.

- Your insurance company must negotiate in good faith. You are entitled to a prompt, fair settlement to repair your car to its pre-accident condition.

- Your insurance company has six days after proper notification to inspect your car. If additional damage is found after dismantling, the insurance company has two business days to re-inspect after proper notification.

- You may legally appoint your repair shop to act as your “Designated Representative,” to protect your interest and negotiate a fair claim settlement with your insurance company.

- The New York State Insurance Department licenses all insurance company personnel including damage appraisers, supervisors, agents, and brokers.

- The insurance company may not issue a check or draft in payment of a claim, implying acceptance of such as final or binding.

- If your automobile is a total loss (cost of repairs exceed the actual cash value of the automobile), payment is calculated by averaging Red Book and NADA values or the use of computerized database, plus NYS Sales Tax. You are entitled to an evaluation worksheet and you have a 30 day Right of Recourse to question the insurance company’s settlement offer.

- If the damages to your car are over $1,000.00, you must fill out a D.M.V form 104.